Financial Strategy

Promote balance sheet management

considering performance indicators

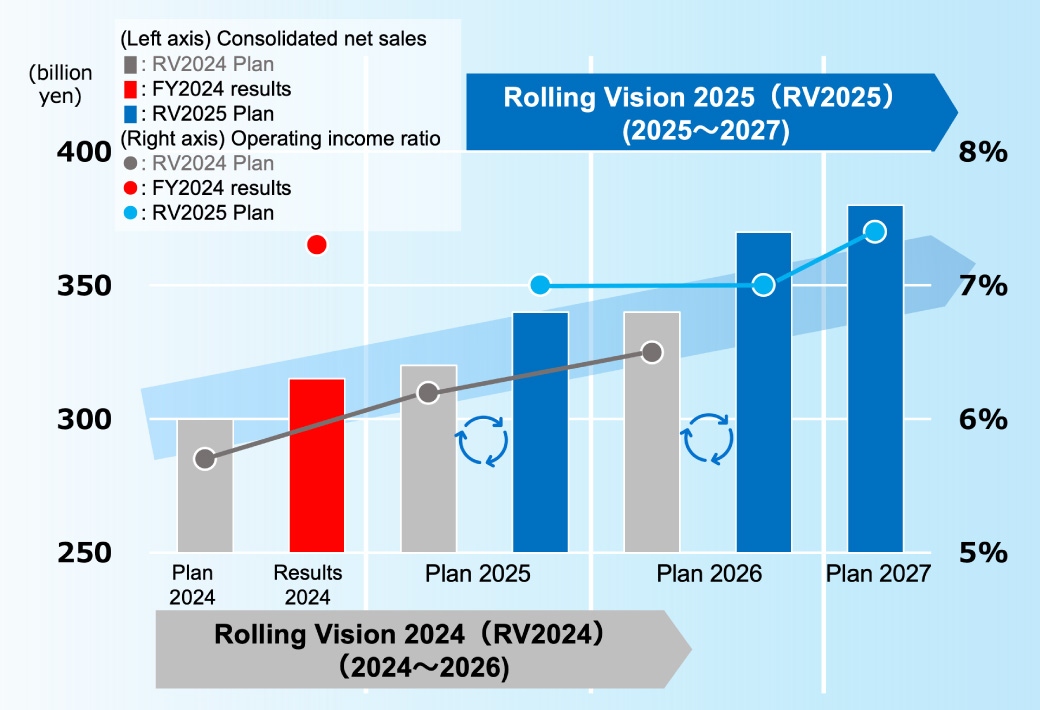

"MITSUI E&S Rolling Vision" is a mid-term business plan designed to depict continuous growth, with targets updated in a rolling approach of planning for the next three years.

In May 2025, based on the financial results for fiscal year 2024 and changes in the business environment, we formulated "MITSUI E&S Rolling Vision 2025," which rolls forward our functional strategies (finance and human resources) and business strategies toward 2027.

To achieve sustainable growth toward our group's vision for 2030, we will continue necessary business investments, implement appropriate dividend policies to return profits to shareholders, and strive to enhance corporate value while balancing shareholder equity costs and debt costs.

Numerical Targets of MITSUI E&S Rolling Vision 2025

FY2024 performance exceeded RV2024 plan. We aim for further growth and expansion through RV2025.

Performance trends (consolidated)

| FY2024 | FY2025 | FY2026 | FY2027 | |

|---|---|---|---|---|

| Net Sales (Billions of Yen) | 315.1 | 340 | 370 | 380 |

| Operating Income Ratio | 7.3% | 7.0% | 7.0% | 7.4% |

| Equity Ratio | 37.8% | 39% | 40% | 42% |

Performance indicators

| FY2024 | FY2025 | FY2026 | FY2027 | |

|---|---|---|---|---|

| ROIC *1 | 9.9% | 9.0% | 9.0% | 9.0% |

| WACC *2 | 7.0% | - | - | - |

| ROE | 25.1% | 11% | 11% | 11% |

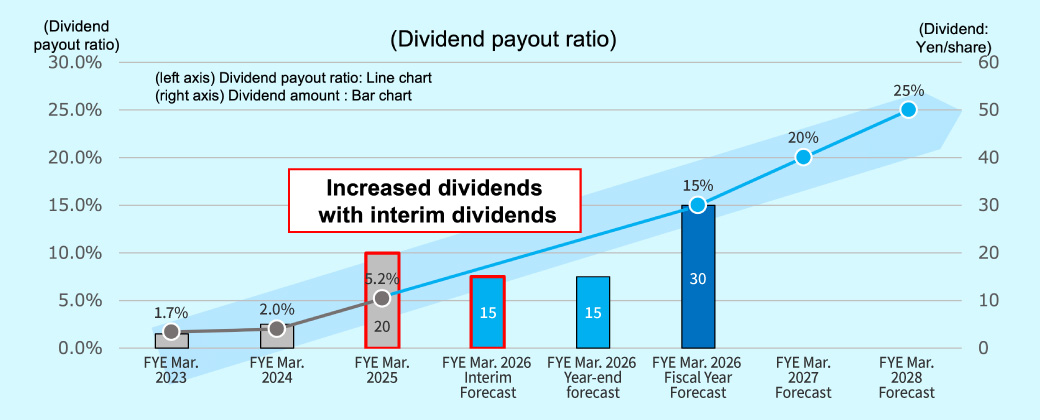

| Dividend payout ratio | 5.2% | 15% | 20% | 25% |

*1 ROIC=(Operating income – Total taxes) / (Average Shareholder’s equity and Interest-bearing debt at the end of the previous period

*2 WACC is calculated based on the stock price at the end of March 2025 (1,644 yen)

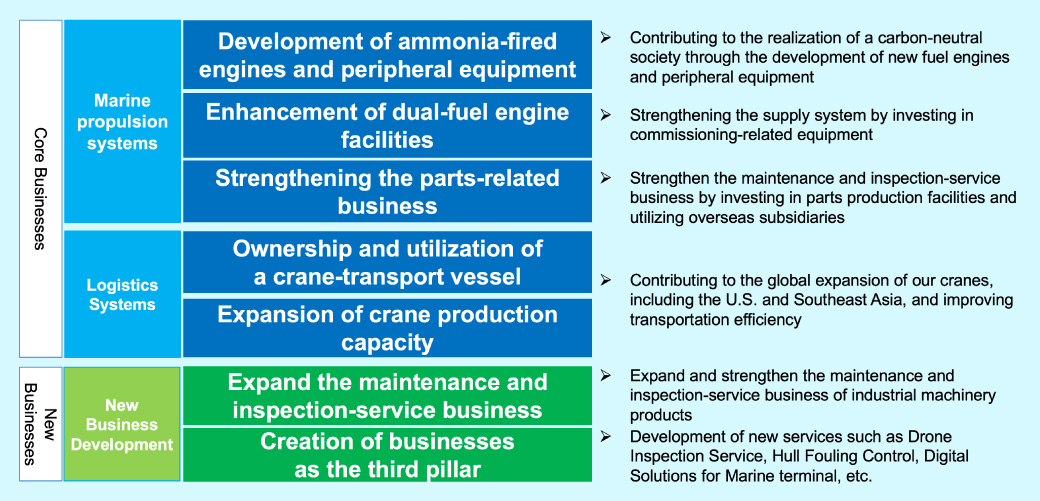

RV2025 Focus Areas

In order to achieve our vision, we will strengthen our core businesses and expand new businesses.

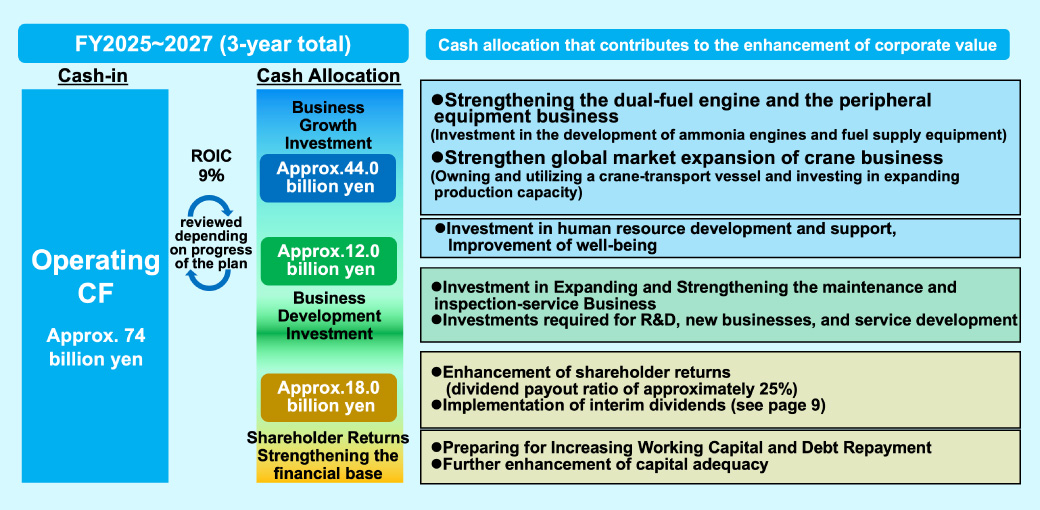

Cash Flow Allocation

Approximately 74 billion yen in cash will be allocated to growth and development,

and 25% will be allocated to shareholder returns and strengthening the financial base.

Dividend payout ratio

We will strengthen shareholder returns in order for shareholders to be able to stay for the long term.